Real Estate Investing in Chicago: A Tale of Two Cities

Real estate investors in Chicago know that understanding Chicago means embracing contradictions and looking beyond the headlines. It has always been this way, of course. From the beginning, Chicago has been a city that has lent itself to sensationalism. One of the first novels written about the city, Theodore Dreiser’s Sister Carrie, portrayed the still new town as one of unimaginable vice and decadence, full of nothing but crooks and criminals. Had you read the book as an investor at the time, you might have fled, assuming that there was no way such a city could survive. We know that’s not true, of course. Chicago has been battered many times and has survived each time. Even today, if you look exclusively at the headlines or overall economic numbers, you might think that things seem unpromising. By digging deeper, however, and looking at certain neighborhoods, we can see that Chicago has a large number of areas that have the right economic and social factors that make them a worthwhile investment. You simply have to look beyond the headlines.

Chicago from Grant Park, a city that contains contradictions, but also great opportunities for real estate investors. Image from Wikimedia Commons

Use a Microscope, Not a Telescope

The national unemployment rate is at 5.3% and in Chicago (depending on how you define the metropolitan area) the number is anywhere between 6% and 6.5%. This is already considerably better than during the dark days of the Great Recession, but it’s still higher than the national average. Additionally, it’s slightly behind the national average when it comes to population growth and projected job growth over the next five years. It’s pretty easy to understand why that’s the case. There are large swaths of the area that are economically depressed. Apart from that, the manufacturing jobs that sustained much of the so-called “Bungalow Belts” in the northwest and southwest sides (near O’Hare and Midway, essentially) have largely left. The O’Hare area is rebounding and changing, as is the Midway area, although more slowly. In addition, as the city budget problems are dealt with, the kind of public employment that was previously the lifeblood of many neighborhoods is being further reduced. So, looking at the big picture, we see there are some problems, though nowhere near as many as city anti-boosters and message-board trolls like to imagine. However, we can’t just look at the distant view if we want to understand what’s happening in Chicago. Slower job growth can be more than balanced out by the existence of the right kind of jobs, and problems in some neighborhoods don’t mean that there aren’t other places experiencing incredible growth and opportunity. Using a microscope to look more closely at Chicago is the right move for smart investors.

The Right Kind of Employment: Why It Matters

There’s no such thing as the “wrong” kind of employment for workers. Having a job is always important. For real estate investors, however, only the right kind of economic conditions ultimately lead to possibilities in the commercial and MDU sectors. Investors look for high-paying jobs in denser urban areas – especially the kinds of jobs that attract a younger crowd. In practice, this typically means jobs at corporate headquarters, startups, and other tech-sector jobs. Chicago is experiencing exactly this kind of shift. While tech sector jobs only make up about 2% of the city’s total employment numbers, they’ve grown 16% since the end of the recession in 2009 (while the city as a whole grew 7% in the same timeframe). Chicago is home to many major tech firms and a huge number of very successful internet companies, such as Groupon and GrubHub. The startup scene is thriving, with thousands of companies competing to become the next big thing. There are several huge incubators and accelerators. This is creating a real physical pressure on the real estate market, which is adjusting to provide the office space that these companies need. Along the river, old factories, which were once the symbol of industrial power, and then sat dirty and decaying on depressing banks, are being turned into both condos and hip, cool office spaces to fit the needs of modern business. River North, the West Loop, and the Downtown Business Area are all seeing huge growth as companies attract young employees, a young and educated base attracts new companies, and space is at a premium.

Why Real Estate Investing in Chicago Makes Sense

It might have been easy to think that Chicago wasn’t going to make it. But you could have said the same thing in 1871 when the city burned down, in 1900 when Dreiser published Sister Carrie, on Valentine’s Day in 1929, after the ‘68 conventions, or any other number of days. That’s Chicago. It has always had a rough side and has always found a way to overcome that. But despite challenges, Chicago continues to attract people the way it has for nearly 200 years. It is a city of opportunity, which never stands still or stops reinventing itself. It is a great place for real estate investors. At Origin, we understand Chicago – we’re based in the city. We know the challenges, but we also know the areas of incredible growth that need the right kind of investing. We know where to look and which trends make up the right kind of potential growth in which neighborhoods. Sure, we read the papers, but we also know they’re just headlines. We know that the real story, as it often does, lies deeper. In Chicago, you just have to know how to look.

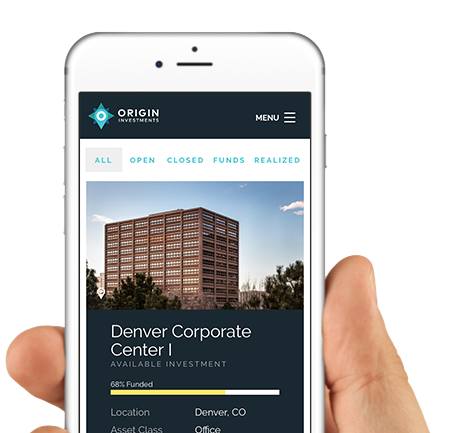

If you are a real estate investor looking to broaden your portfolio and join other investors in major developments, Origin Capital Partners would be excited to work with you. At Origin Capital Partners, we have a powerful connection with the cities we invest in, and we understand what makes them tick. We know which areas are booming and which commercial and residential investments will make the most sense moving forward. Our Funds deliver consistent returns, because we know how to make sense of the real estate market. Contact us today to talk about how your investments can grow with the city.