Frequently Asked Questions

Origin Capital is an institutional real estate investment platform that acquires office and multi-family properties on behalf of its principals and investment partners. Origin excels in deal sourcing, risk management, revenue generation and communication. Origin acquires and develops multi-family and office assets in eight target U.S. cities and has offices in Chicago, Atlanta, Dallas and Charlotte.

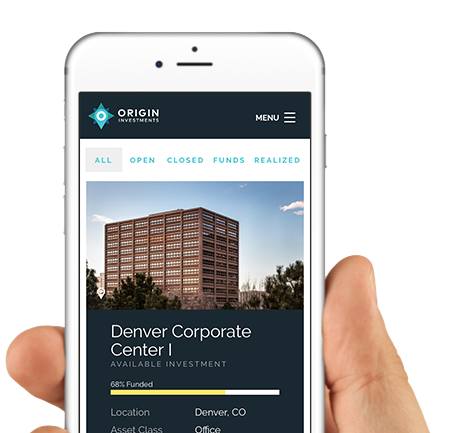

Offerings are available to accredited investors who register on Origin’s secure online investment portal. Click on the “Get Started” button to begin setting up your account. Once registered, you will have access to detailed information on available offerings, such as location, business plans, full deal analysis and performance projections. Click “Invest Now” when you are ready to invest in a deal. From there, you can follow the steps to verify accreditation, sign legal documents and fund your investment directly in the portal.

At Origin, we stand behind the services we provide to our investors. If you are not happy with our services, including our investment memoranda, communications and reports, we will work with you to make things right, and if you are not fully satisfied, we will refund your investment at your request. This satisfaction guarantee is only available to new Origin investors and is limited to $250,000 per investor. No fees, charges or market losses will be refunded. Additional details about our guarantee can be found at origininvestments.com. For additional information regarding fees, please see the Private Placement Memorandum provided to you at the time of your investment or upon your request.

Origin’s Service Guarantee

The Origin service guarantee is only available to new investors for the first twelve (12) months following their initial investment with Origin. If at any time during the first twelve (12) months following your initial investment you are not completely satisfied with the services being provided to you by Origin, at your request Origin will refund the amount of such initial investment up to $250,000, less applicable management fees and charges. You will receive a refund of amounts covered by this guarantee within approximately four weeks of your request. No other fees, charges, expenses, or market losses will be refunded. The maximum cumulative amount of all refunds made under this guarantee is limited to $5 million. Origin reserves the right to change this guarantee in the future upon publication of such changes on this website. For additional information regarding associated program fees, please see the Private Placement Memorandum provided to you at the time of your investment or upon your request.

- Earn an individual income of more than $200,000 per year, or a joint spousal income of more than $300,000 per year, in each of the last two years and expect to reasonably maintain the same level of income

- Have a net worth exceeding $1 million, either individually or jointly with his or her spouse (excluding the primary residence)

- Be a bank, insurance company, registered investment company, business development company, or small business investment company

- Be a general partner, executive officer, director or a related combination thereof for the issuer of a security being offered

- Be a business in which all the equity owners are accredited investors

- Be an employee benefit plan, a trust, charitable organization, partnership, or company with total assets in excess of $5 million

1. Design for Security: We believe in security throughout every level of our customer’s experience. Therefore, our development, technical, and support staff are trained to improve and maintain upon our platform with security in mind, and do so with the support of the highest levels of our organization.

2. Standardized Security Controls: All components are held to the same standards of compliance to security policies, redundancy, and resilience against attacks.

3. Continuous Monitoring and Review: By remaining vigilant on our systems through audits and regular reviews, we maintain the integrity of our system and continue to enhance our user’s experience.

Where necessary, Origin Capital works with 3rd party services in an effort to provide our customers with the most efficient and secure experience possible. In such cases, these core components of our policy still apply.

LICCAR is both an alternative fund administrator and a full-service public accounting firm located in the heart of the Chicago’s financial district. The firm is primarily comprised of CPAs and MBAs with significant experience in the alternative investments industry either from a public accounting background or actual operational experience as former CFOs or Controllers. LICCAR's business model allows them to easily scale their services to specifically meet each client's needs and their client financial reporting can be easily customized to meet specific client requirements, providing unparalleled flexibility.