Real Estate Crowdfunding: A New Horizon for Smart Investors

There’s something magical and humbling about driving toward a city when you can still see its skyline in the sunny distance. When you are far enough away, you can hold up your hand and fit the entire city in a circle between your thumb and forefinger. It’s amazing to think that there are hundreds of thousands of people in that spot, so small from your perspective. As you get closer to these gleaming canyons, their size grows, as does that of the people filling them, and you recognize how complex and connected an entity a city really is. It makes you want to be a part of it in a real way. At the same time, at least until recently, that size made you realize how difficult it would be to invest in real estate.

A city skyline contains almost infinite opportunity and real estate crowdfunding can help you get involved.

Image source: Wikimedia Commons

Real estate is obviously a capital-intensive investment. Whether a building is being constructed from the ground-up or bought with renovation in mind, any mid-to-high-end property is out of the range of most individuals and even many smaller and mid-sized investment groups. But that is starting to change. Thanks to the advent of real estate crowdfunding, more people can invest and profit from the market. That city you saw in your hand can also be in your pocket.

Understanding How Crowdfunding Works

Crowdfunding is essentially normal investing processed through communication technology, sped up, and disseminated globally. In its essence, it is no different than normal investing. People see a project that they like and contribute money in the hopes that the project will be a success and they will reap the benefits. This has been the case for everything from the Titanic to IBM.

The difference is that crowdfunding lets everyone get involved. The most famous online crowdfunder is Kickstarter, which has projects ranging from cutting edge virtual reality headsets to your niece’s boyfriend’s poetry project. Anyone can invest in it and be rewarded for their different levels of contribution, whether that is receiving said virtual reality headset, gaining access to an online game, or enjoying a private poetry reading from your niece’s boyfriend.

What that kind of crowdfunding rarely does is allow you to share profits. It was an exciting but limited model, and one that showed how such an expansive and convenient system could work on a broader and more traditional scale. It could open up the system to more people and help spread the risk around.

A good example of this is real estate. For a few years, real estate crowdfunding was limited to investors with $1 million net worth, or an annual income of over $200,000. However, recent laws, including the Jumpstart Our Business Startup Act of 2012, have opened it up to anyone. So how does this help the investor?

Crowdfunding Real Estate

Let’s look at a small investment group, one with (to make the math easier) $5 million dollars they want to invest in real estate. This is not an insubstantial amount, but it is also not an enormous amount. A $5 million dollar investment in a new building gives them a decent stake, but it is also a risk. The temptation when you are dealing with limited amounts of capital is to avoid spreading it around since you don’t want to be spread out too thinly, but putting all your investment in one building can potentially be a disaster.

This leaves a few options, both of which revolve around crowdfunding. This first option is to raise funds on your own and get people to join in your investment. Rather than go to the mountain, you have them bring the mountain to you. Smaller investors can join in on a building cost, leaving you the primary partner.

Another great option, and arguably better, is to join an established team that uses the principles of crowdfunding to spread risk, minimize danger, and maximize profit. By adding your smaller amount to a bigger stream, you have a better chance of increasing the returns on your investment. There are more properties to choose from because there is a larger pool than there would be with individual investors.

The key is knowing which crowd to help fund. It’s the difference between kickstarting the next big tech tool or a movie with a washed-up sitcom star. Your group will want to choose from a crowd with a proven track record, the size to make an impact, and the research capabilities and flexibility of a small and nimble firm.

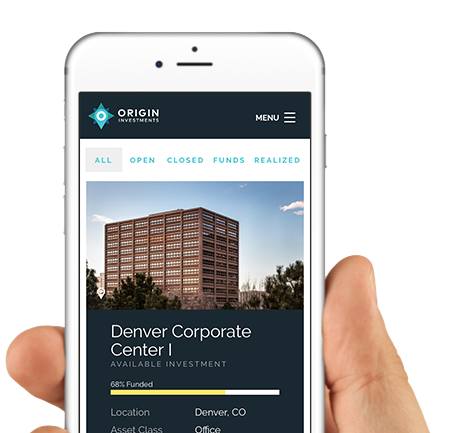

At Origin Capital, we make sure that any investments we make on behalf of our partners – the crowd that joins us – are the same investments we’d make on our own. We’re still the principal investor in any property, so you know that our interests are 100% aligned. And that’s the key to the new economy. Is the crowd working together? Or is it just a motley rabble? When it comes to crowdfunding real estate, you want to know that the skyline is in the right hands.

If you are a real estate investor looking to broaden your portfolio and join other investors in major developments, Origin Capital Partners would be excited to work with you. At Origin Capital Partners, we have a powerful connection with the cities we invest in and we understand what makes them tick. We know which areas are booming and which commercial and residential investments will make the most sense moving forward. Our Funds deliver consistent returns, because we know how to make sense of the real estate market. Contact us today to talk about how your investments can grow with the city.