The Chicago Real Estate Market: Origin Capital’s Investment Strategies For A Changing Economy

Real estate in Chicago mirrors the city itself: it is audacious, bold, and constantly reinventing itself. Chicago is a city that saw a narrow, shallow, sand-choked river running through a muddy marsh and used it to open a continent. It’s a canal city that became the nation’s railroad hub. It’s a city that was destroyed by fire and came back ten times stronger and shook off post-industrial decay to become a skyline of steel and glass, attracting new businesses and residents and, in the process, transforming itself yet again. It is the kind of city where real estate investments pay off.

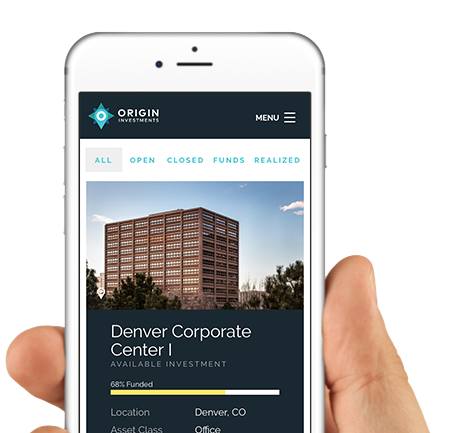

At Origin Capital, we understand Chicago. We’re based here and we know what makes the city tick. More importantly, we know which neighborhoods are worth your time and investments. Our local presence allows us to make a rigorous study of the city, investing our capital and our partners’ capital in the underserved $10-$30 million-dollar market range. We know that, from the beginning, real estate is what has made Chicago run, and we know how to make it work for you.

What You Need to Know About Chicago Real Estate

Like many big cities, Chicago has had its share of economic turmoil, especially since the most recent recession. For many, that has led to a negative appraisal of the city overall. However, at Origin, we don’t look at a city from a satellite view. We zoom in, get on the street level, and find out what’s really going on. We take a neighborhood-by-neighborhood approach to the Chicago real estate market and look at the factors that make up the more complete picture. Here are a few key facts that we analyze when looking at the Windy City:

- Neighborhood Growth: Many neighborhoods far exceed the city, and even the national average, when it comes to growth. Neighborhoods like the Commercial Business District, River North, the West Loop, and other areas (see below) are booming.

- New Business Attraction: For decades, 5th-floor hands were wrung over businesses leaving for the suburbs. Now they’re worried about finding office space for all the businesses coming back, moving in for the first time, or starting up. The Chicago tech scene is booming and with it comes both startups and established companies, as well as non-tech businesses looking to attract strong talent. This is the key factor to the real estate growth in Chicago.

- A Younger Population: More business means more people moving in – specifically, a younger and more educated Millennial generation looking to take advantage of the competitive Chicago job market. In some neighborhoods, as many as 80% of the residents have a college degree. They are attracted primarily by the exciting new jobs, Chicago’s excellent public transportation system, green policies, stimulating nightlife, and natural beauty.

Culture changes and the economy follow suit. The Chicago real estate market is adapting to the influx of residents and businesses by building multi-family homes, like apartments and condos, as well as more office and commercial space. The younger population will continue to impact Chicago for years to come. As of the 2010 Census, a full 25% of Chicagoans were under the age of 18, and with the new job market, many of them are expected to stay as the city continues to transform. Knowing the right neighborhoods for your investments will allow you to take advantage of a growing market.

The Key Neighborhoods for Chicago Real Estate Investments

Origin targets the right submarkets that are ready for growth and whose properties can benefit from targeted capitalization. Some of these in the Chicago real estate market include:

- River North: Although known to some as a tourist area, the native population of this neighborhood is growing, with new high rises in the nightlife corridor, as well as new townhouses and condos being created from the warehouses north of Wolf Point. With a median household economy of over $70,000 and a smaller household size, this region is key to Chicago’s MDU growth, and it’s seeing a resurgence in commercial property as well.

- West Loop: Once home to nothing but butchers and packing houses, this trendy neighborhood is now the city’s culinary hotspot and one of the hottest places for startups to open their offices. The neighborhood has maintained some grit even as prices skyrocket, making this a great place to invest in MDUs and commercial property.

- Chicago Business District: Better known as “the Loop,” the CBD is the heart of Chicago’s economic engine. Office space continues to be in huge demand and buildings are struggling to keep up with the needs of new tenants. That makes this neighborhood an ideal place for investment and capitalization.

- South Loop: The area south of the Museum Campus and Soldier Field was long a wasteland, but the last decade has seen it bloom and fill with new tech offices and MDUs. It’s now one of Chicago’s hottest neighborhoods.

- North Side: Wicker Park, Wrigleyville, Bucktown, Lincoln Park – all of these neighborhoods have distinct characteristics and lifestyles, but all have younger populations starting families, staying in the city, and demanding safe, smart, green MDUs. These are all great places for investments.

The Chicago commercial and residential real estate market is entering a period of growth and transition as this city adjusts to a younger generation and a new economic driving force. As the history of the city shows, Chicago knows how to adapt and change. Having the right targets for your investment, and the right group to invest with, can help you be a part of Chicago’s next phase.

If you are a real estate investor looking to broaden your portfolio and join other investors in major developments in Chicago, Origin Capital Partners would be excited to work with you. At Origin Capital Partners, we have a powerful connection with the cities we invest in and we understand what makes them tick. We know which areas are booming and which commercial and residential investments will make the most sense moving forward. Our Funds deliver consistent returns, because we know how to make sense of the real estate market. Contact us today to talk about how your investments can grow with the city.