The Fulcrum: Taking Advantage of Leverage in Your Real Estate Investments

Finding success as an investor in the real estate market is all about taking simple principles and applying them in a systematic, disciplined fashion. In this way, it is a lot like learning about machines. In school, we learn about simple machines: the wheel, the pulley, the fulcrum, and the lever. We learn how they help us accomplish things that we couldn’t accomplish on our own, allowing us to multiply our strengths while minimizing our weaknesses. It’s the same with real estate. There are basic principles to follow to help you maximize your chances of success while also diminishing the odds of losing money. One of these is leverage.

Leverage is an investment tool that is popular across many fields, including bond trading and the futures market. In its essence, it involves an investor using as little of their own money as possible to make a purchase, borrowing the remainder, and paying off the loan while enjoying profits when the item purchased sells for a higher price. In real estate, it can be a great way to get in on potentially lucrative property that you might not be able to afford on your own. We’ll take a look at real estate leverage, how you can use it, and how to understand the risks.

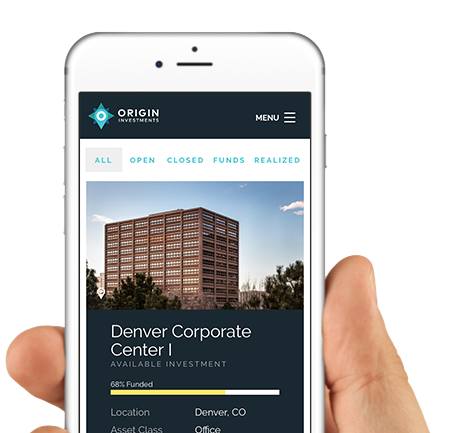

Houston is a great example of a city where leverage can help a real estate investor smooth over predictable peaks and valleys. Image from Wikimedia Commons user hequals2henry

Real Estate Leverage: How It Can Multiply Profit

Most people think they’re familiar with the term leverage from movies and TV, when some high-rolling investor is complaining that they “are leveraged to the hilt” and thus in trouble. That makes it sound like it’s only used on the high plateau of the very rich, but the truth is, nearly everyone who buys a house uses it. A mortgage is a form of leverage – you’re using the bank’s money to make a purchase, paying only the down payment. Of course, very few of us think of that as leverage because it’s for a small property, and because most people aren’t buying a house simply as an investment strategy. But when you start to expand on that principle, to apply it forward, you can see how this works as a large-scale strategy.

Imagine that you, or a group with whom you are investing, pool together $5 million dollars. You can make a decision to buy a building that is worth $5 million and then sell it a year later for $6 million, making a 20% profit, which is a very good profit. That’s a solid investment strategy.

But say there are five buildings available, each selling for $5 million. What if your group puts a down payment of $1 million on each of them and uses leverage to buy the rest? That’s essentially borrowing $20 million. If each of the buildings is sold at $6 million a year later, you then pay back the money you have leveraged, leaving you with $10 million. $5 million of that is your initial investment and $5 million is profit. That’s a profit of 100%, which is certainly much better than 20%.

Managing the Risks of Leverage

Of course, those are very round numbers, and one thing they don’t take into account is interest on the loans, which will cut into those profits. How much depends on the terms you are able to get (which is, of course, partly dependent on the reliability and history of the group you’re working with). That doesn’t change the underlying principle; it just makes the profits a little smaller and the math slightly more complex.

What does change the principle is that not every investment is a success. The problem with the fulcrum is that if there is something heavier on the other side, you are teeter-tottered into the unknown. If the real estate market crashed in our scenario, you wouldn’t be out $5 million, but $25 million, plus interest. Again, these are big, round numbers, and life is rarely that neat. That’s why having a broader portfolio of investments is often a good idea- it spreads the risk around. Think of the above example: if one building collapsed to $2 million but the others went up to $7 million, the profit would still be approximately the same. Leverage means you don’t have to put all your eggs in one basket. You can take the initial amount and spread it over multiple properties.

The important thing is to not over-leverage yourself. It’s tempting to use it as an ATM, or even a roulette wheel. You shouldn’t ever borrow more than you can afford to lose, which is why it is an excellent strategy to invest with partners who can draw in money from other investors, spreading the risk. Ideally, you’ll have a team that understands the markets they are in and knows how to capitalize to improve value. This is a great way to leverage your assets without incurring large risks.

Leverage Case Study: Houston

The Houston real estate market is a prime example of how leverage can help. Houston has been one of the leading engines of Texas’ economic growth. Indeed, just this year, Forbes said it was “still America’s economic miracle.” Now, that economic growth is also partly dependent on the oil sector, which was booming for years. Last year, however, it hit a slide, which led some in the commercial real estate market to worry. With oil no longer at $100 a barrel, some projects were paused, especially new developments in downtown Houston.

For small investors, this could be a cause for concern. Short-term fluctuations can hurt when you have everything tied up in the one investment you could afford. That’s why partnering with a company like Origin Capital can help you out in the Houston market. The overall economy is far more diverse than just oil. That’s a dominating sector, but Houston is far from being a cardboard boomtown. It has a thriving startup scene, which attracts educated and affluent residents, bringing in even more businesses. While there are projects on hold, there are many more going forward.

Leverage can help you participate in the Houston economic “miracle.” It allows for greater diversity of investment and a spreading of risk. Using leverage correctly is a great way to take advantage of the simple tools that make up the backbone of our industry.

If you are a real estate investor looking to broaden your portfolio and join other investors in major developments in Houston or other markets, Origin Capital Partners would be excited to work with you. At Origin Capital Partners, we have a powerful connection with the cities we invest in and we understand what makes them tick. We know which areas are booming and which commercial and residential investments will make the most sense moving forward. Our Funds deliver consistent returns, because we know how to make sense of the real estate market. Contact us today to talk about how your investments can grow with the city.