The Millennial Effect: How Young Buyers Are Reshaping the Chicago Residential Real Estate Market

The culture and economy of a city are intertwined, with each impacting the other’s development. As Chicago is getting younger and more high-tech, it is attracting younger residents that will alter the real estate market, both residential and commercial. A good symbol of this is Millennium Park. Start with the name: “Millennium Park” was a sign that Chicago was moving past its always-gritty and sometimes-grimy 20th century experience. At a time when glass and steel residential towers started reflecting the eastern sun onto a rehabilitated downtown, the park – an expansive garden in the city – was replacing a worn-out eyesore of a rail yard just north of the Art Institute. It was a way to make the lakefront whole, from the river to Soldier Field.

It was also symbolic of the generation with which it would share a name: the Millennials. Millennium Park opened late and was beset by huge financial difficulties. When the park was opened, though, people quickly forgot about those troubles because it had a huge impact on the city. When it comes to the housing market, Millennials are much the same: many are financial wrecks who didn’t start buying homes until later than any other generation. They are currently entering the real estate market in full force, however, both renting and buying property, which will have an enormous effect on Chicago real estate. To understand which real estate investments make the most sense and which neighborhoods are developing, we need to understand where this generation lives and what it is looking for. That’s the key to a sound investment strategy.

Even raised bridges can””t stop Millennials and businesses from rushing back into Chicago””s downtown, River North, Lakeview, and other neighborhoods.

Where Millennials Live in Chicago

The Millennial Generation, defined as anyone born between 1980 and 1995, is enormous. At approximately 72 million, it challenges Boomers as the largest American generation ever. And while Millennials are obviously spread out over the country, they are disproportionately located in Chicago. Indeed, Chicago is increasingly defined by this generation. According to Redfin, 7 out of the top 14 zip codes with the largest Millennial populations are in Chicago. Some of these zip codes include:

- 60607 (West Loop)

- 60613 (Wrigleyville)

- 60614, Lincoln Park

- 60622 (Wicker Park)

- 60654 (River North)

On the surface, these neighborhoods are extremely diverse. Indeed, the “Wicker Park vs. River North” split would seem to echo a distinction between “hipsters” and “young professionals.” More concrete (and less facile) analysis shows that these areas have a lot in common, which is both important for broader real estate trends and for Millennials in particular.

All of these areas are defined by access to public transportation. You can trace a line with the Red Line through most of the areas, with some of the northern ones branching off along the Brown Line. The Near West Side is serviced by the Green, Pink, and Blue Lines, and, of course, Wicker Park has several famous Blue Line stops.

What these areas also have in common is that they have undergone huge transformations in the last 20 years. Many of those neighborhoods had very disreputable, if not wholly sketchy, reputations. They are now filled with new and renovated buildings, upscale restaurants, boutiques, gyms, and other amenities. As we’ll see, this is exactly what Millennials are looking for.

Understanding What Millennials Want in the Chicago Residential Real Estate Market

This is the year that Millennials are finally entering the housing market with eyes toward purchasing. This isn’t the whole generation, of course; many, still feeling the impact of the economic crunch and student loans, are renting. Apartments, condos, and other multi-family dwelling units (MDUs) like townhomes are considerably more attractive for a generation that is generally uncomfortable with sprawl, but still looking to plant some roots.

What this means is that transit-oriented hubs full of multi-use MDUs will be the most attractive type of new and refurbished housing. Multi-use buildings combine residential, retail, commercial, and leisure property in one complex. This is important for Millennials because it cuts down on the need to drive, and allows for more walking, bike-riding, and conservation.

Conservation is extremely important, which is why rehabilitated neighborhoods are a great place to invest. Older buildings that are torn down or rehabbed, or empty lots that are the beneficiaries of urban infill, can allow for construction and retrofitting that is both smart and green. Technology and energy-efficiency are going to be hugely important for Millennials as they decide where to buy or rent. A neighborhood that became gentrified in the 80s or 90s, before new trends took hold, is both too new and too old for many Millennials.

The Return of Business and the Impact on Housing

For years, people took note of the “reverse commute” as a sign that the city was dying. It was easier to get into the city during the morning than it was to get out of it, as businesses flocked toward the suburbs. That has shifted again. Responding to a new economy, and to the younger culture of Chicago, businesses are coming back. High-tech companies want to be downtown or in the collar neighborhoods. This is partly due to there being room in the office market, but also due to the desire of younger skilled employees to avoid a long commute to work. They want to work where they live and live where they work.

The last few years have seen companies like Motorola, Capital One, and Hillshire Brands close up shop in the suburbs and move into the city. Regional giant Walgreens is considering doing the same. They are doing this for reasons of price, but also because the city is where the talent lies. They are following the example of Chicago’s hot start-up culture and becoming urban companies.

There is a ripple effect, showing how culture and the economy intertwine. As more tech companies move in, so will more young, talented Millennials. This will encourage more companies to move in, which will create a demand for more residential real estate (and commercial real estate, of course). The culture of a city changes, and with it, the economy.

Let’s look a prominent Northside neighborhood to see how this can all come together, providing a template for other areas.

Investment Case Study: Ravenswood Corridor

On the North Side, splitting its way between booming Lincoln Square and North Center, is the Ravenswood Corridor, a street split by the Metra tracks, once a long stretch of industrial grime. A quick look at it shows us what is most important to Millennials in a neighborhood and what to look for when investing:

- New businesses: The factories have been slowly replaced by artisanal shops, tech startups, friendly bars, and cutting-edge restaurants, while still maintaining an “urban” feel.

- Public transportation: Serviced by both the Brown and Red Line, major bus routes, and the Metra, the Corridor is a non-driver’s dream.

- Bike-friendly: The Corridor boasts a wide-open road with little traffic.

- New housing: Several factories have been converted into cool condos and other MDUs, with plenty of mixed-use property available.

It’s little wonder why this is a developer’s dream and a great place to invest. Whether people are moving into MDUs to rent or to buy, the area is going to continue to develop and grow, creating great places to invest. There are areas like this all over Chicago, which is shedding the Nelson Algren “city on the make” reputation as it becomes a tech haven and a green-oriented, youth-focused kind of town. Understanding both the powerful pull of the Millennial generation and what they want is a great way to guide your investments in the Chicago residential real estate market.

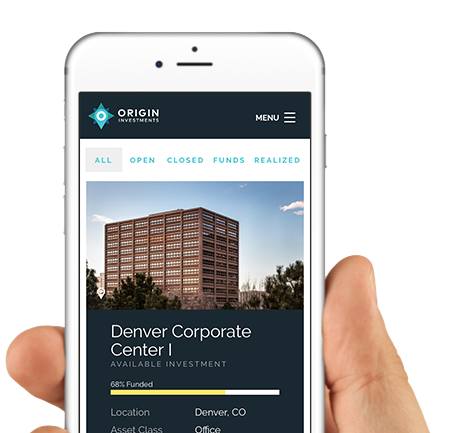

If you are a real estate investor looking to broaden your portfolio and join other investors in major developments in Chicago, Origin Capital Partners would be excited to work with you. At Origin Capital Partners, we have a powerful connection with the cities we invest in and we understand what makes them tick. We know which areas are booming and which commercial and residential investments will make the most sense moving forward. Our Funds deliver consistent returns, because we know how to make sense of the real estate market. Contact us today to talk about how your investments can grow with the city.